调查称亚洲亿万富翁财富增长最快

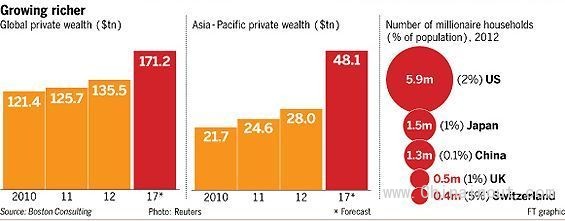

一项年度调查显示,过去12个月,亚洲亿万富翁创造财富的速度快于全球任何其他地区,期间全球亿万富翁财富总值达到7.3万亿美元,增长12%,亚洲贡献了其中近三分之一的增长。

调查称,亿万富翁控制着全球近4%的财富,过去一年新增155位亿万富翁,这将全球亿万富翁总数推升至创纪录的2325位,较上次调查增加7%。

纽约的亿万富翁数量最多,为103位,接下来为莫斯科85位,香港82位,伦敦72位,北京37位。

周二,软银(SoftBank)创始人孙正义(Masayoshi Son)取代日本迅销公司(Fast Retailing)创始人柳井正(Tadashi Yanai),成为日本首富,这得益于即将启动的阿里巴巴(Alibaba)首次公开发行(IPO)。孙正义的个人财富达到166亿美元。

欧洲亿万富翁数量(775位)及其财富总额(2.37万亿美元)均为全球之冠。亚洲亿万富翁的财富增速为全球最快,在调查期间财富增加18.7%,而全球平均增幅为11.9%。

在截至今年7月的12个月里,亚洲亿万富翁数量增加10%,有52位新富豪加入这个行列,其中33位来自中国内地。

在今年的调查中,亿万富翁财富总额曾在2013年夺冠的北美被欧洲取代。

美国仍是全球亿万富翁数量最多的国家,共有571位亿万富翁,接下来是中国内地(190位)和英国(130位),德国(123位)位居第四,将去年的第三位让与英国。

Wealth-X和瑞银表示,“财富从婴儿潮时代出生的人们向他们的继承者转移的巨大浪潮”正在出现,结果是,部分财富为继承而来的亿万富翁数量增加最快。

Wealth-X和瑞银表示:“然而,全球亿万富翁的共同特点之一是他们的创业精神。在多数情况下,取得亿万富翁地位不仅仅需要继承财富:81%的亿万富翁是靠自己的努力赚取大部分财富的。”

调查期间,每位亿万富翁将持有的现金及现金等价物(例如股票或债券)从上次调查的平均5.40亿美元增加至6亿美元。

这两个数字均占各自调查期间亿万富翁平均资产净值的19%,现金资产价值增速加快的原因是本次调查期间总财富增长。

Wealth-X和瑞银表示,亿万富翁持有现金的规模表明,很多人“正等待最佳时机继续投资”。(更多资讯请关注中国进出口网)

Asian billionaires create wealth fastest

Wealth was created faster by Asia’s billionaires than by those in any other part of the globe in the past 12 months, with the region accounting for almost a third of a 12 per cent increase in global billionaire wealth of $7.3tn, according to an annual survey.

The combined wealth of the world’s billionaires is now higher than the combined market capitalisation of all the companies that make up the Dow Jones Industrial Average, according to the survey, conducted between June last year and July by Wealth-X, a research firm, and UBS, the Swiss-based bank.

Billionaires control nearly 4 per cent of the world’s wealth, the survey claims, with 155 new billionaires minted in the past year, pushing the global population to a record 2,325 – a 7 per cent rise from the last period surveyed.

New York hosts the biggest number – 103 – with Moscow (85), Hong Kong (82), London (72) and Beijing (37) taking the next four spots.

On Tuesday, SoftBank founder Masayoshi Son overtook Tadashi Yanai, founder of Fast Retailing, to become Japan’s richest man, boosted by the forthcoming Alibaba initial public offering. Mr Son has a personal fortune of $16.6bn.

Europe, with 775 billionaires, was the region with the most billionaires and billionaire wealth ($2.37tn). Asia boasted the largest billionaire wealth increase, with fortunes growing by 18.7 per cent over the period surveyed, compared with a global average rate of 11.9 per cent.

Asia’s billionaire population grew 10 per cent in the 12 months to July, with 52 new entrants into the billionaire club – of whom 33 were from China.

North America – the region with the most billionaire wealth in 2013 – was overtaken by Europe in terms of wealth in this year’s census.

The US maintained its position as the world’s top billionaire country with a population of 571 billionaires, followed by China (190) and the UK (130), which took third spot from Germany (123).

Wealth-X and UBS said a “massive wave of intergenerational wealth transfer from baby boomers to their heirs” was under way, with the result that billionaires with partially inherited wealth were the fastest-growing segment of this population.

“Yet, one of the common characteristics of the world’s billionaires is their entrepreneurialism. In most instances, achieving billionaire status requires more than merely inheritance: 81 per cent of billionaires made the majority of their fortunes themselves,” the two said.

Billionaires increased their holdings of cash and cash equivalents such as shares or bonds in the period to an average of $600m each from $540m last time.

Both amounts were the equivalent of 19 per cent of average net worth, with the increase in value of cash holdings rising because total wealth increased in the period.

Wealth-X and UBS said the level of cash held signalled that many are “waiting for the optimal time to make further investments”.

(更多资讯请关注中国进出口网)